What is the ROI for Commercial Solar in Oregon? A 2025 Analysis

Key Highlights

- Strong Investment: Commercial solar in Oregon provides an excellent return due to high utility rates and strong state/federal incentives.

- Rapid Depreciation: The Modified Accelerated Cost Recovery System (MACRS) allows businesses to deduct a large portion of the system cost quickly.

- Payback Window: Typical payback periods for commercial systems often range from 3 to 7 years , depending heavily on facility type and power consumption.

- Incentive Stack: Businesses can stack the 30% Federal Investment Tax Credit (ITC) with MACRS and local Energy Trust of Oregon cash rebates.

- Budget Certainty: It provides immediate protection against unpredictable PGE rate hikes, converting variable operating expenses into fixed capital assets.

What is the ROI for Commercial Solar in Oregon? A 2025 Analysis

For small business owners and commercial property managers in Oregon City and the wider Portland Metro area, electricity bills are not just a nuisance—they are a significant, constantly rising operating expense.

When a national solar company pitches you commercial solar, they focus on the “green marketing.” At Energy Solutions , we focus on your bottom line. Commercial solar is not a marketing tool; it’s a high-yield, long-term capital investment that drastically lowers overhead.

As your NABCEP Certified local energy consultants, we’ve analyzed the financials for warehouses, small offices, agricultural operations, and retail centers. Here is our 2025 breakdown of the ROI (Return on Investment) for commercial solar in Oregon.

The Three Pillars of Commercial ROI

The Return on Investment for a business is calculated differently than for a residential homeowner. It’s driven by three powerful financial mechanisms:

Pillar 1: The Energy Offset (Operating Expense Reduction)

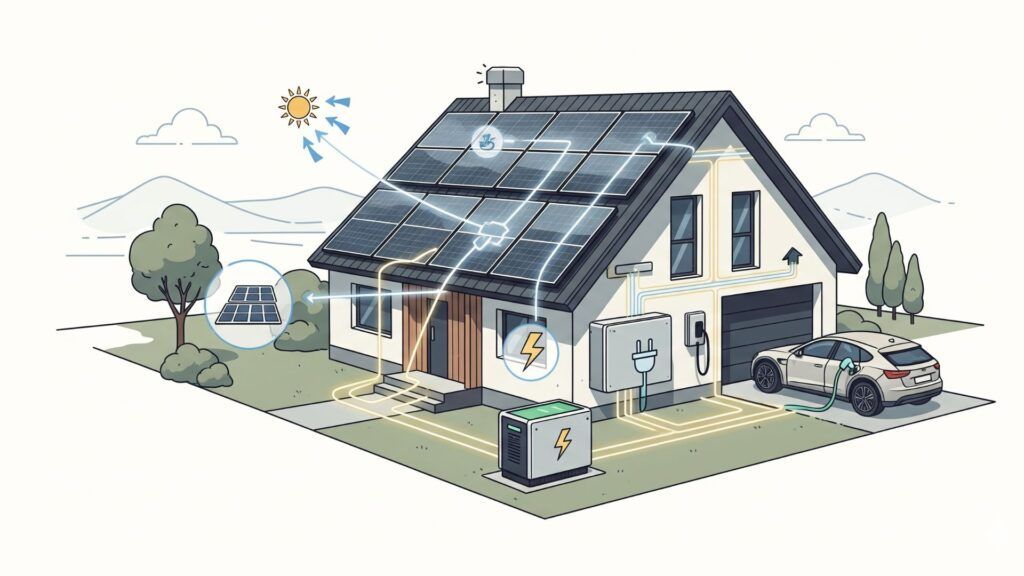

This is the most straightforward return. Every kilowatt-hour (kWh) your commercial solar system produces is a kWh you do not have to purchase from PGE or other local utilities.

- Commercial Rates are High: Commercial and industrial customers often pay higher rates and face complex “demand charges” that penalize peak usage. Solar immediately wipes out a significant portion of this high-cost power.

- Net Metering: Like residential systems, commercial systems benefit from Net Metering, earning credits for excess power sent back to the grid.

Pillar 2: The Federal Investment Tax Credit (ITC)

This is a massive, immediate financial boost. Businesses can claim 30% of the total system cost as a direct credit against their federal tax liability. This credit significantly reduces the upfront cost of the system.

Pillar 3: Accelerated Depreciation (MACRS)

This is the single greatest financial driver for commercial solar. The Modified Accelerated Cost Recovery System (MACRS) allows businesses to recover the cost of a tangible capital asset (like a solar array) over a shorter time period than its actual useful life.

- The Benefit: Solar is classified in the 5-year MACRS schedule. This means you can typically deduct approximately 85% of the system’s cost from your taxable income within the first six years. This deduction translates directly into significant tax savings, often in the first two years of operation.

Calculating the Payback Period

When combining energy savings and tax deductions, the payback period for commercial solar is usually much faster than residential.

Example Scenario (Typical Oregon City Office Building)

| Metric | Value | Notes |

| System Size | 100 kW | Covers substantial electricity usage. |

| Total Cash Cost | $250,000 | Pre-incentive cost. |

| Year 1 Energy Savings | $20,000 | Reduction in annual utility spend. |

| Federal ITC (30%) | -$75,000 | Immediate reduction of tax liability. |

| MACRS Deduction Value | ~$48,000 | Total value of accelerated tax deductions. |

| Net Cost (After Tax Benefits) | $127,000 | True capital outlay after incentives. |

| Payback Period | ~6.35 Years | ($127,000 Net Cost / $20,000 Annual Savings) |

Depending on your business’s tax liability and power use profile, we regularly see payback periods ranging from 3 years (for high-consumption businesses taking maximum advantage of depreciation) to 7 years (for low-consumption facilities).

The Advantage of Local Incentives (Energy Trust of Oregon)

In addition to the strong federal incentives, commercial customers in the Portland area often qualify for cash rebates through the Energy Trust of Oregon (ETO) .

- Cash Rebates: ETO frequently offers direct cash incentives per watt installed, further driving down the initial capital expenditure.

- Certified Partner: As an Energy Trust of Oregon partner, we ensure your project is designed and installed according to their rigorous standards, maximizing your rebate eligibility.

It is essential to work with a local installer who knows how to “stack” these incentives correctly, ensuring you don’t leave any money on the table.

Financing Commercial Solar

Most businesses treat solar as a capital expenditure, utilizing commercial loans, leases, or specialized Property Assessed Clean Energy (PACE) financing.

- Commercial Loans: Term loans, often structured to match the useful life of the asset, are the most common approach. We can connect you with local Oregon banks and credit unions familiar with green energy projects.

- Solar Leases: While generally poor for residential use, commercial solar leases can sometimes be advantageous for non-profit entities or businesses with low immediate tax liability, allowing them to benefit from the tax deductions passed through to the lessor.

Beyond the Dollar Sign (Non-Financial ROI)

While the financial return is the primary driver, commercial solar offers secondary returns that are increasingly valuable to Oregon businesses:

- Hedge Against Rate Hikes: You buy certainty. Your energy source is fixed, protecting your operating costs from PGE’s unpredictable rate increases for the next 25+ years.

- Corporate Image: In the eco-conscious Pacific Northwest, demonstrating commitment to sustainability is a competitive advantage that appeals to customers and top talent.

- Future-Proofing: Commercial solar installations are easily paired with Generac or industrial-grade battery storage, providing critical backup power to keep servers, vital machinery, and essential systems running during grid failures.

The Bottom Line: An Investment You Can Trust

Commercial solar is no longer a niche technology; it is a smart, proven financial strategy that immediately benefits your balance sheet. The combination of massive federal tax incentives, accelerated depreciation, and operational savings makes the payback period rapid and the total return immense.

As Oregon City’s leading commercial energy consultants, we don’t just install panels; we design financial solutions. We handle the complex permitting (structural, electrical, and PGE interconnection), the engineering, and all the tax paperwork necessary to ensure you maximize your ROI.

Ready to turn your roof into a profit center? Get My Free Quote or call our local team at 503-680-3718 to schedule a comprehensive commercial site assessment and financial analysis.